American Airlines Sues JetBlue After Failed Partnership Talks

Negotiations to revive cooperation between the former Northeast Alliance partners have collapsed, American reveals

by Lauren Smith

April 29, 2025

Photo: Courtesy of Airbus SAS / Alexandre Doumenjou

Don’t expect American Airlines to cozy up to one-term partner JetBlue anytime soon. Recent talks to renew the alliance between both carriers have gone so poorly that American is now suing JetBlue to recover money it said it’s owed from their previous partnership.

In a letter to staff on Monday, American Airlines chief strategy officer Steve Johnson confirmed that the negotiations with JetBlue had broken down. He said American had made “a very attractive proposition to JetBlue” but “it became clear over time that JetBlue was focused on different business priorities.

Looking Back: The Northeast Alliance

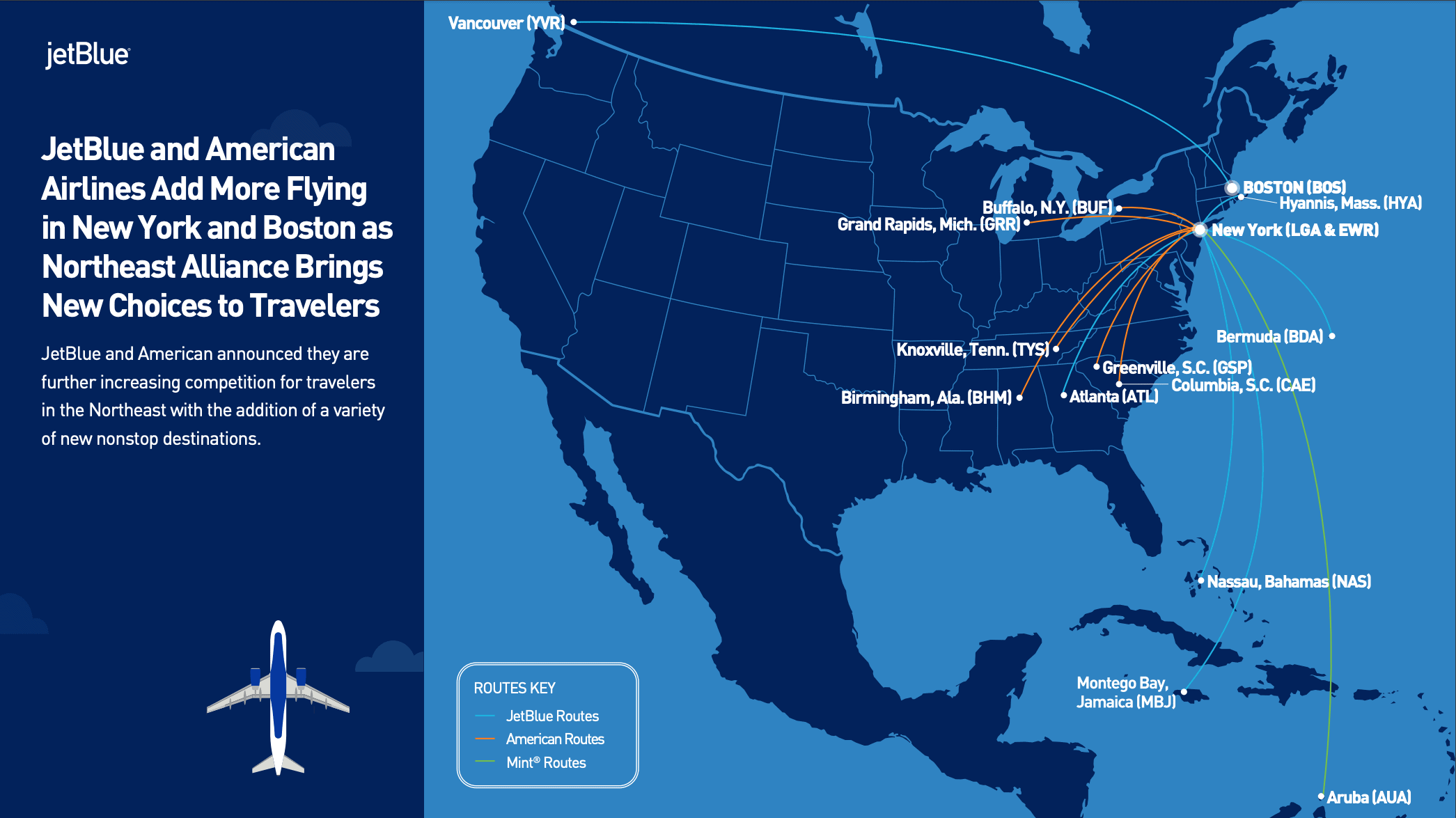

American and JetBlue previously collaborated between 2021 and 2023 under the so-called Northeast Alliance. Under the deal, the one-time rivals coordinated flight schedules between New York and Boston and shared or swapped landing slots at the cities’ crowded airports. They also codeshared on key routes in the region and gave AAdvantage and TrueBlue members reciprocal loyalty benefits on flights.

Photo: Courtesy of JetBlue Airways

The airlines said collaboration enabled them to better compete with Delta and United, which are more established in the region. However, under former President Biden and six neighboring U.S. states, the Department of Justice (DOJ) disagreed and successfully sued to block the Northeast Alliance on anti-trust grounds.

They argued that the coordination by American and JetBlue reduced competition and could increase ticket prices, a decision upheld by an appeals court last November. JetBlue and American began winding down their partnership in July 2023.

JetBlue Looking For A Match

However, with the business-friendly Trump administration back in office, the airlines recently rekindled their relationship.

JetBlue has made no secret that it’s in the market for a new partner. The airline, which has struggled to turn a profit since the pandemic, believes a deal with a competitor would enable it rapidly to expand and better compete with the Big Three.

The New York-based carrier nearly purchased Spirit Airlines for $3.8 billion but was again thwarted by the Biden administration. The deal was blocked by a federal judge in January 2024.

Photo: Spirit Airlines and JetBlue. Courtesy of Randolph Rojas / Unsplash

A year later, with business-friendly Trump back in the White House, JetBlue renewed its search and has been linked to multiple airlines, including United and Southwest.

Still, JetBlue never quite forgot American. In February, JetBlue’s President Marty St. George spoke nostalgically about the one-time Northeast Alliance, which he said was “never fully played out.”

Meanwhile, American viewed JetBlue as a way to compete in the prestige New York market, where it’s long been locked out by United and Delta. American remains fourth in the Big Apple for passenger numbers, behind its fellow Big Three members and JetBlue.

In March, American even asked the Supreme Court to review decisions by lower courts to break up the Northeast Alliance.

Unavoidable Divorce

But regardless of whether the Supreme Court hears the case, it now seems unlikely that American and JetBlue will team up.

According to Johnson, the airlines “were unable to agree on a construct that preserved the benefits of the partnership we envisioned, made sense operationally or financially, or was consistent with the travel rewards and co-branded card business objectives that are so important to our strategy and our customers.”

Photo: Courtesy of JetBlue Airways

American also filed a lawsuit in Texas seeking to recover more than $1 million owed by JetBlue following the breakup of the Northeast Alliance. Johnson told staff that American had “understandably tabled this claim while we were in discussions with JetBlue.” Now that those negotiations have collapsed, American is trying to recover the money through the courts.

JetBlue said it has worked collaboratively with American to wind down the Northeast Alliance. “We plan to review American’s complaint, and as this is pending litigation, we cannot comment further at this time,” a spokesperson told Reuters.

Johnson said American “remain[s] intently focused on and [is] competing aggressively in New York and Boston” without JetBlue. The Texas-headquartered airline has added more than 20 new routes from New York (JFK) and LaGuardia (LGA) airports over the last year, using slots returned to it by JetBlue. Alongside codeshare partners like British Airways and Qatar Airways, it will offer more than 250 daily flights from New York over the summer.

American has also seen growth in its AAdvantage membership in the region, which makes it “confident that the New York market is sufficiently large and lucrative to support and value multiple competing networks,” Johnson said.