Americans Heading to Points Unknown

Some four in 10 American workers have lost wages and work across most industries due to the coronavirus, according to a sad survey by LendingTree.com

March 24, 2020

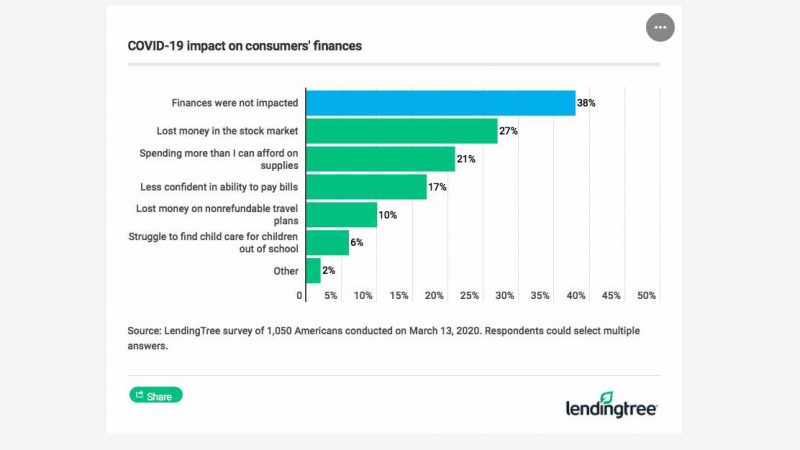

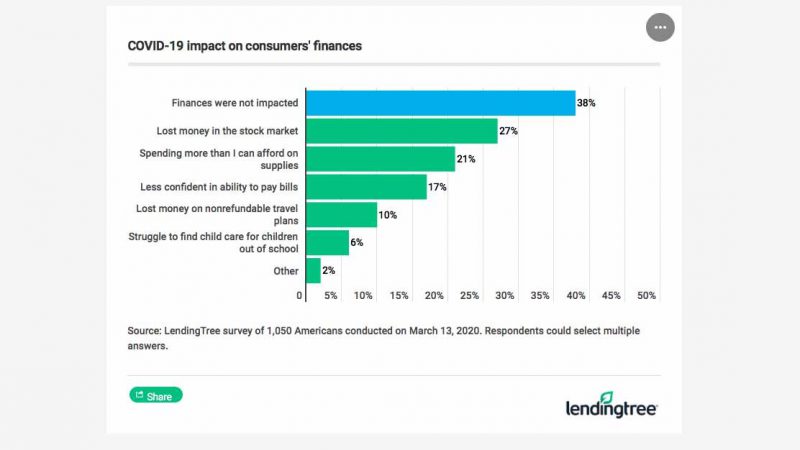

Nearly two-thirds (63 percent) of consumers have already felt the economic impact of the coronavirus outbreak in some way, according to a LendingTree survey of 1,050 Americans conducted on March 13, and 44 percent are worried about their ability to pay rent or their mortgage in the midst of the global pandemic.

Key findings:

• 63 percent of consumers agreed their personal finances have been impacted by the coronavirus in some way. More than a quarter (27 percent) lost money in the stock market, and about one in five (21 percent) are spending more money than they can afford on supplies.

• About 4 in 10 working Americans said their paycheck has been negatively impacted due to the coronavirus pandemic. That jumps up to 51 percent of employed Gen Z and 44 percent of employed millennials.

• 44 percent of Americans are worried about their ability to pay rent or their mortgage amid the coronavirus pandemic, and 23 percent are concerned about affording their monthly credit card bills.

• One in six Americans (17 percent) worries about the cost of medical treatment should they contract the coronavirus.

Looking ahead, Americans fear financial instability due to coronavirus. Tendayi Kapfidze, chief economist at LendingTree, predicts that stunted consumer spending due to the outbreak will lead the country into a recession.

One in five has overspent on supplies

A solid 21 percent of Americans are spending more than they can afford on supplies, stockpiling as a result of the virus by buying food, cleaning supplies, water, paper products and other necessities. Seventeen percent are less confident in their ability to pay bills, which could lead to ballooning fees if they’re unable to pay off their credit card balance before interest kicks in.

Nearly a quarter of Americans worry about their ability to pay bills amid the COVID-19 pandemic. They also harbor anxiety about the cost of medical treatment, losing their retirement savings, losing employment and even paying for child care.

Consumers also worry they won’t be able to pay credit cards

The average credit card balance is $6,354, according to CompareCards, leaving borrowers with significant monthly payments. With this in mind, 23 percent of Americans are worried about their ability to make a credit card payment due to the coronavirus pandemic.

“The changes in consumer behavior will likely lead the U.S. into recession,” said Kapfidze. “After an initial boost in consumption due to preparation, spending is set to contract sharply as broad sectors of the consumer economy shut down.”

The LendingTree survey was conducted by Qualtrics as an online survey of 1,050 Americans, with the sample base proportioned to represent the overall population. The survey was fielded March 13, 2020.

Generation Parameters:

• Gen Zers: 18-23

• Millennials: 24-39

• Gen Xers: 40-54

• Baby boomers: 55-74

• Silent generation: 75 and older