Daymond John on ‘Shark Tank’, Crypto Crashes, and Teaching Financial Intelligence

One of the country’s foremost entrepreneurs, John has made it his life’s work to pass on his hard-won business acumen

by Alix Sharkey

February 1, 2023

Daymond John / Photo: Courtesy of The Shark Group

If you’re of a certain age—let’s say old enough to recall LL Cool J dropping his 1985 debut album, Radio—then you’ll remember Daymond John first as the young, up-by-the-bootstraps founder of the phenomenally successful hip-hop clothing label FUBU. Conversely, if your demographic brand is millennial or Gen Z, you’re more likely to know him primarily as the smooth, shaven-headed and goateed kingpin from ABC’s reality show Shark Tank, oozing style and sophistication in his Tom Ford suits, custom shirts and Italian silk ties.

John, who turns 54 this month, is widely reported to have a $350 million net worth. But he has never forgotten his roots, when he first started hand-sewing ski hats in 1989 in the front room of his family home in Hollis, Queens, selling printed T-shirts from the back of his van outside the Harlem Apollo Theater, and hustling and grinding every day.

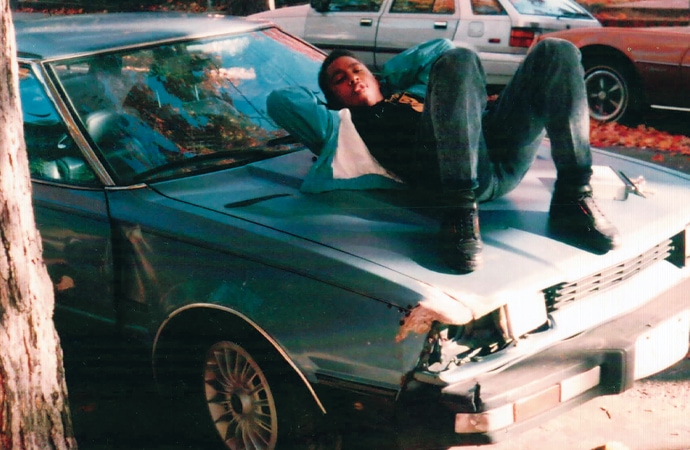

John in his high school days / Photo: Courtesy of The Shark Group

Perhaps his biggest break came when fellow Hollis habitué LL Cool J and former manager Charles Fisher decided to pay it forward by supporting local businesses, including FUBU—an acronym meaning “For Us, By Us.” Soon he was wearing John’s brand for shows and video shoots, but the seismic shift happened in February 1999, when the rapper was hired to appear in a Gap television commercial. LL Cool J pulled off an astonishing marketing coup: Not only did he sport a white FUBU ball cap with his white Gap T-shirt and “easy fit” Gap jeans, but one line of his freestyle also name-checked the brand:

G-A-P, gritty/ready to go / For Us, By Us / on the low

The reference went over the heads of Gap creatives and stylists, but millions of kids instantly connected. With an estimated $30 million media spend, the ad drove huge numbers of young urban consumers to Gap stores nationwide—many of them looking for that FUBU cap rather than the baggy jeans. Although initially nonplussed by this stealth marketing, Gap executives were placated by a 300 percent increase in sales to the Black community. Meanwhile, FUBU became a global streetwear brand with annual sales in excess of $350 million. Daymond John never looked back.

The FUBU founder with Tommy Hilfiger / Courtesy of The Shark Group

Along the way, however, he had to educate himself, often through painful and costly lessons, in manufacturing, marketing and distribution and—most importantly—cash flow and fiscal responsibility, or what he terms “financial intelligence.” That’s why he has made it his life’s work to pass on his hard-won business acumen, notably in a series of award-winning books, including 2016’s The Power of Broke: How Empty Pockets, a Tight Budget and a Hunger for Success Can Become Your Greatest Competitive Advantage, followed by 2018’s Rise and Grind: Outperform, Outwork, and Outhustle Your Way to a More Successful and Rewarding Life, and most recently 2020’s Powershift: Transform Any Situation, Close Any Deal, and Achieve Any Outcome. And next month sees the publication of Little Daymond Learns to Earn, an illustrated children’s book aimed at elementary school kids. Why the shift of focus to children?

“Our country’s in trouble,” says John. “We have been for a long period of time. I normally would not have done a children’s book, but I’m on my second marriage and I have another little girl in my life, my six-year-old, Minka. And I realized our schools don’t teach our kids financial intelligence. We teach them their ABCs and lullabies and various other things, but they need more sophisticated information, critical thinking about finance and values and friendships. They don’t have a Mister Rogers anymore, and even Sesame Street doesn’t work the way it used to.” His hope for Little Daymond Learns to Earn, he says, is that parents and kids will read it together and start having more discussions about managing finances. “Not enough families are teaching kids how to manage their money, problem-solving, nutrition, stuff like that.”

On a similar theme, last October he hosted the third annual Black Entrepreneurs Day, sponsored by Chase Bank, at New York City’s Apollo Theater. The live-streamed event to “empower and celebrate entrepreneurs everywhere” featured one-on-one Game Changer Conversations with Black businesses leaders and cultural icons including Shaquille O’Neal, Tracee Ellis Ross, Spike Lee, Venus Williams and Killer Mike, all moderated by John.

“I interviewed all those artists and athletes, and asked them, ‘How did you get your financial intelligence? How do you start a business? Tell me about all the mistakes you made. What do you feel that you should have known?’ Shaq talked about his first paycheck. He said he didn’t know what FICA was, or that he had to pay taxes, and how stupid he felt.”

Every year, says John, the event awards ten $25,000 business grants to Black entrepreneurs and small business owners. “In the last three years we’ve given almost $800,000,” he says.

John in Queens, New York City, with student winners of his Rise and Grind Award / Photo:

Courtesy of The Shark Group

In John’s progress from street fashion creator to social activist, one thing has remained consistent: his attitude. His morning routine starts with a repetition of his mantra, “rise and grind,” and then moves swiftly on to his constantly updated list of goals. “I have six or seven goals, and I read them aloud every single morning. They range through health, family, career and business.” Four or five of those goals, he explains, will have a six-month deadline, while the others will expire in five, ten or 20 years. He has been doing this routine so long now, he says, that it’s hardwired. But to amp himself up for optimum performance, he still repeats the goals aloud while running or working out in the gym to stirring instrumental music.

“I have a very specific soundtrack with music from Bill Conti, Vangelis and other cinematic composers, soundtrack music from Rocky, Chariots of Fire and Conan the Destroyer, driving epic orchestral stuff to get the adrenaline pumping while I repeat my goals and visualize achieving them.” Moving on to business in general, I ask his take on the recent collapse of the FTX crypto exchange, its CEO’s indictment for fraud, and the resulting tremors throughout the crypto world. Was he heavily invested in crypto, or naturally wary of it?

“I was never big in crypto because I did my due diligence and only dabbled, never investing more than I could afford to lose without losing sleep. But it’s not just crypto you have to be wary of. Unfortunately, there are some excellent thieves out there, people who have only one job—thinking about how to steal from you and me. So while we work 20 hours and sleep four, trying to build a business, they are working 20 hours a day on how to steal from us while we get our four hours’ sleep. In the end I look at the FTX implosion as a critical reset. It’ll create a lot more scrutiny, and people are gonna be much more cautious going forward.”

No buyer’s remorse over crypto, then. But does he ever worry about other investments he ought to have made but passed on?

“I don’t regret anything I might have lost out on, because if I do that, I’ve also gotta count all the times I passed on something and dodged a bullet, right? For example, I would have won a little bit on Uber, but I passed on it. So maybe there are four times I would have hit big, when I have literally turned down 4,000 offers. The money I’d have lost on those 4,000 projects I passed on? That would way surpass any profits I might have made on those four hits.”

That’s the harder side of John, his tough inner core. For most people, though, he’s best known for his charm and easy smile as a central character in all 14 seasons of Shark Tank, the multiple Emmy-winning reality show in which a panel of five high-rolling investors, or “sharks,” evaluate business pitches from a series of hopeful entrepreneurs and then decide whether to invest in their companies.

In episode eight of the most recent season, John invested in Sliimeyhoney, a company founded and run by a high school student from his parents’ garage in Burbank, California. To general amazement, 17-year-old Mark Lin explained that jars of his homemade, nonedible, food-scented slime—in “flavors” such as banana milk, hot cocoa crunch and birthday cake batter, which sell for $10 to $16 per six-ounce container—had brought in at least $1.2 million in three years with a marketing strategy built around his 960,000 TikTok followers. And all this while still making grades to land an undergrad placement at UCLA.

@sliimeyhoneyshop Here were my favorite moments from Shark Tank! Let me know other questions you have in the comments 💬 Slime shown: Winter Wonderland ❄️ #slime #slimeshop #smallbusiness #sharktank ♬ Monkeys Spinning Monkeys – Kevin MacLeod & Kevin The Monkey

After a brief bout of haggling and faced with a difficult choice between John and fellow “shark” Kevin O’Leary, the teenager struck a handshake deal with John—who agreed to pay $150,000 for a 20 percent stake in Sliimeyhoney. “I believe in you,” John told him.

But what got John to jump at the deal? Was it the kid or his product? Maybe the packaging and marketing strategy?

“My investment decision,” he explains, “is always a three-part combination. First, can I add value here? Second, do I like the product? And third, do I like the person? If I like the product but can’t add value, I’ll just buy one of them, right? I don’t need to buy the company.”

On the other hand, if he likes the product and believes he can add value, he’ll ask himself whether he wants to spend time with the entrepreneur. If not, he’ll look to put in place certain “firewalls” to ensure a strictly business relationship.

“But the winner is always when I get all three. In this case I knew I could add value, because I deal with a lot of toy companies. I liked the product because I have a six-year-old and she likes slime. And I liked the person because this kid is brilliant. Nobody’s gonna stop this young man. I mean, he just started college and already has $400,000 in his bank account? That’s insane.”

Known as “the people’s shark” for his warm, engaging on-screen persona (as contrasted with the harsher, brasher O’Leary, a.k.a. “Mr. Wonderful”), John laughs when recalling how he almost turned down the show. Not once, but twice.

On Shark Tank with fellow panelists Mark Cuban, Kevin O’Leary, Lori Greiner and Matt Higgins / Photo: Jessica Brooks/ABC via Getty Images

“The producers called me and said, ‘We’re doing this great show and we’d like you to be on it. It’s all about investing, so you have to spend your own money.’ So I said, ‘Thank you. Goodbye.’ I’m like, These Hollywood people are pimps! I understand not getting paid, but damn! They got to the point where I gotta pay to be on the show? What’s wrong with these people?

“Anyway, they call me back, so I say, ‘I’ll do the show but only if I can speak personally to [Shark Tank supremo and reality show mega-producer] Mark Burnett, because I have ideas for three amazing TV shows I want to pitch.’ So they fly me out to L.A. but I don’t get to see Mark Burnett. Instead, I do these little sizzle reels for the pilot, and they tell me, ‘By the way, you can’t do any other show but ours.’ And I say, ‘Well, I’m sorry but I’m already doing product placement for another reality show with these three girls I know.’ Again, they say, ‘You can’t do any other show but ours.’ I said, ‘Alright, well, I appreciate this opportunity, and good luck. I gotta go.’

“You know,” he laughs, “when you hang up on Hollywood producers, they get real hot and excited. So then I get a call from a buddy of mine saying, ‘I heard you gave up on Mark Burnett’s new show because you’re working with three girls named the Kardashians that nobody will ever know. Why would you ever do that?’ And I said, ‘Well, I’m a man of my word.’

“Anyway, Mark Burnett knows Kris Jenner, so Khloé Kardashian found out that I was going to turn down the show. So she said to me, ‘Look, we want to work with you, but you need to do Shark Tank. The world needs to know who you are. So you’re fired.’ Yep. That’s what she said!” And did he finally get to pitch his TV shows to Burnett? “Well, first we did some kind of teleconference, but still no Mark Burnett, and they’re explaining the show and they’re like, ‘Hey, we’re gonna get Mark Cuban.’ And I’m like, ‘Mark Cuban, the billionaire? He doesn’t need TV time. And what’s he gonna do, invest in sponges?’ I thought these guys were lying. So I said, ‘Look, I wanna talk to Mark Burnett about my three smoking hot TV ideas.’ They said, ‘Alright, do the show and we’ll get you the meeting with Mark.’ So finally we have breakfast, and Mark knocks down all three of my TV shows before the goddamn orange juice even gets to the table.”

Daymond John chuckles, then lets out a sigh. “But hey,” he says, “I guess Shark Tank took off.”