A federal judge in Boston has ruled that the Northeast Alliance between American Airlines and JetBlue Airways violates the Sherman Antitrust Act. The decision gives the airline partners 30 days to end the arrangement.

Ruling on a lawsuit brought by the Justice Department along with six states and the District of Columbia, US District Judge Leo Sorokin found that the partnership “substantially diminishes competition in the domestic market for air travel.”

The Department of Transportation greenlighted the alliance in the waning days of the Trump administration in exchange for commitments to safeguard competition, including giving up slots in New York and Washington and assurances that the carriers would not cooperate on setting prices.

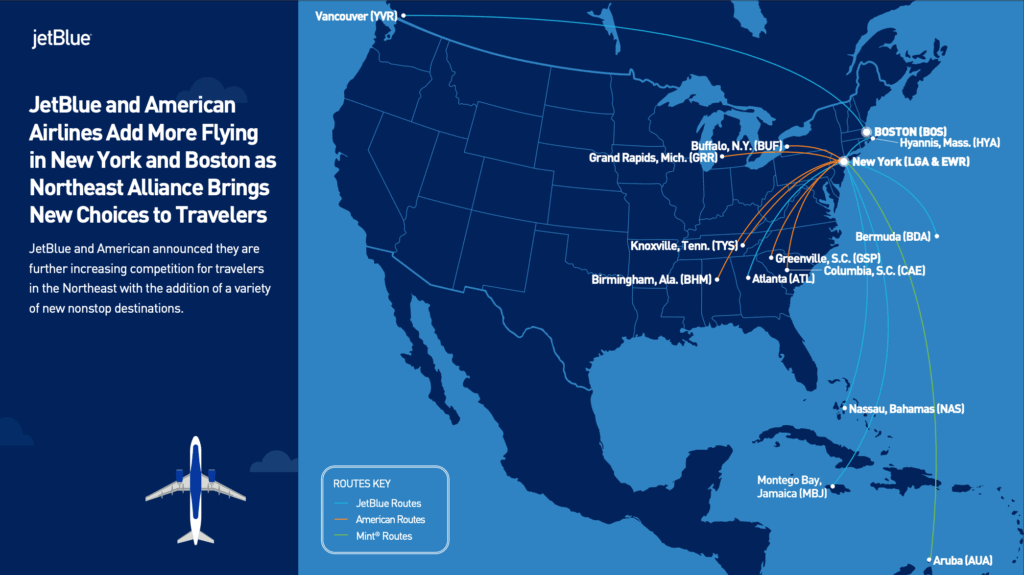

Photo: Courtesy of JetBlue Airways

The partnership, launched in early 2021, allowed the two carriers to coordinate schedules and share revenue on routes to and from New York and Boston.

After President Joe Biden took office, he issued a sweeping executive order in July establishing “a whole-of-government effort to promote competition.” The order called DOJ to “challenge prior bad mergers that past administrations did not previously challenge.”

Subsequently, the Biden DOJ sued to block the American-JetBlue alliance, claiming it constituted a “de facto merger” of the airlines’ Boston and New York operations that would stifle competition and “significantly diminishes JetBlue’s incentive to compete with American elsewhere.”

The Facts Before the Court

In its suit, the Justice Department argued that the alliance concentrates a significant market share in the hands of the two airlines on routes out of the New York, Boston, and Washington airports.

According to one economist cited in the DOJ suit, if American and JetBlue are not competing against one another in the Northeast, the deal could potentially cost consumers an additional $700 million annually, or about $30 per passenger on those routes based on 2022 statistics from the Transportation Department.

During testimony, the airlines countered with expert witnesses who asserted that the government could not show that the alliance had led to higher fares. Instead, the deal had been instrumental in allowing them to start some 58 new routes from New York and Boston, increase frequencies on other routes, and plan new international destinations.

Photo: Courtesy of JetBlue

Furthermore, the airlines claimed the partnership benefits consumers by creating a more competitive market in the Northeast, countering the dominance of rivals Delta and United.

Nevertheless, Sorokin dismissed the airlines’ arguments for consumer benefits, writing, “Though the defendants claim their bigger-is-better collaboration will benefit the flying public, they produced minimal objectively credible proof to support that claim.”

In addition to failing to show how the pro-competitive benefits of the alliance would justify the “anticompetitive harms,” Sorokin also saw the tie-up between the two carriers as having violated established antitrust law.

Calling the arrangement “a naked agreement not to compete,” Sorokin wrote, “Such a pact is just the sort of ‘unreasonable restraint on trade’ the Sherman Act was designed to prevent.”

What Lies Ahead?

Both airlines responded, expressing dismay at the outcome while not ruling out possible appeals. “The court’s legal analysis is plainly incorrect and unprecedented for a joint venture,” American Airlines said in a statement, adding that the alliance “has been a huge win for customers and anything but anticompetitive.”

JetBlue called the decision disappointing, adding, “We are studying the judgment in full and evaluating our next steps as part of the legal process.”

The decision to end the alliance creates a complicated picture for both carriers in the highly competitive Northeast air market. The two airlines partnered on services in this critical region to create a viable third competitor to Delta and United at New York airports and to challenge Delta in Boston.

Photo: Boston-Logan International Airport. Courtesy of Philippe Murray-Pietsch / Unsplash

Although appeals seem likely, the alliance’s future is uncertain, putting pressure on American Airlines to rebuild its operations at JFK and LaGuardia without the benefit of the feeder routes the partnership with JetBlue provided.

Conversely, the alliance allowed JetBlue to grow its corporate business in New York. Without it, the carrier will likely lose the slots it picked up in the deal and face slot constraints in its home market as it tries to grow its market share there.

Effect on JetBlue-Spirit Merger

The ruling also casts a shadow over JetBlue’s other legal matter, the $3.8 billion acquisition of ultra-low-cost carrier Spirit Airlines. That merger is also facing a separate Justice Department lawsuit seeking to block the deal, again on the grounds of stifling competition.

On the one hand, the JetBlue-Spirit deal is more straightforward, with one airline buying out another. As industry analyst Mike Boyd of the Boyd Group put it, with the acquisition of Spirit’s assets, “JetBlue can build into a much stronger competitor, while Spirit is, in large part, offering low-fare, high-value impulse travel, and not service that is core demand in any of its markets.”

Illustration: Courtesy of JetBlue Airways

Sorokin’s decision could embolden the Justice Department in its quest to target further consolidation in the airline industry. But, of course, that bodes ill for any merger or acquisition.

After all, in announcing the Northeast Alliance decision, US Attorney General Merrick Garland called it “a win for Americans who rely on competition between airlines to travel affordably,” adding that “The Justice Department will continue to protect competition and enforce our antitrust laws in the heavily consolidated airline industry and across every industry.”