American Airlines and JetBlue’s Alliance Projected to Cost Travelers $700 Million

The Northeast Alliance (NEA) provides vital new routes, but it has also prompted antitrust concerns from the U.S. Department of Justice

by Lark Gould

January 10, 2023

Photo: Courtesy of Danila Hamsterman / Unsplash

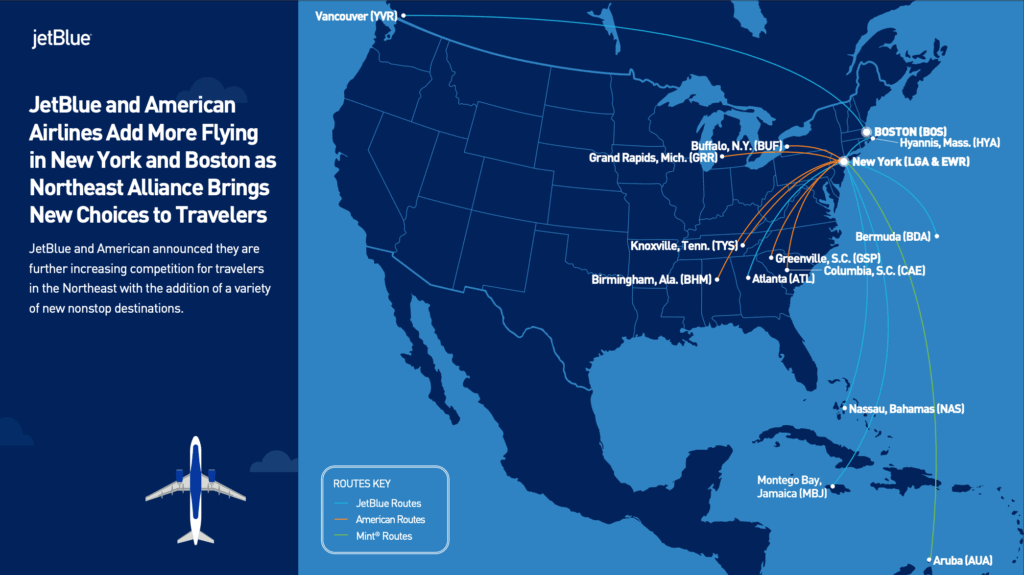

In the airline industry, alliances and mergers are simply the price of doing business. In mid-December, JetBlue Airways and American Airlines announced the addition of 11 new nonstop flights out of their Boston and New York hubs to increase the presence of its Northeast Alliance (NEA) in the region.

The NEA is being tested in federal court as a concept that can either open up seats and lower fares or eventually dominate the market and eat up the competition. The airline alliance allows the companies to take advantage of each other’s networks and services and offer passengers from the U.S. northeast regions better access to the Sunbelt.

Photo: Courtesy of JetBlue Airways

The NEA was officially formed in 2020 to maximize lift in the Boston and New York metro areas. Outgoing Trump-appointed Transportation Secretary Elaine Chao approved the move as a system that promotes the coordination of schedules at Boston (BOS), New York Kennedy and LaGuardia (JFK and LGA), and later Newark (EWR) airports.

New Routes Resulting from the Northeast Alliance

The latest announced route additions within the alliance are mostly domestic once-daily flights except for Atlanta and Buffalo. Atlanta should see eight new daily U.S. flights, Buffalo will see three, and Greenville two. Other spots will be Knoxville, Hyannis, Birmingham, Alabama, Columbia, and Grand Rapids. However, the expansion also reaches the international destinations of Nassau, Vancouver, and Bermuda.

For this go-round, the NEA will offer nearly 300 daily departures from JFK and 49 of the top 50 global markets in 2023. Overall, across New York’s three major airports, the NEA will fly more than 500 daily departures next year and nearly 200 daily flights from BOS.

Photo: Courtesy of JetBlue Airways

The NEA pact seeks to overcome obstacles historically faced by each airline in challenging other carriers’ dominance in the region. Thus, since forming, the NEA has described itself as a third, full-scale competitor in New York in the form of a virtual network that closes longstanding competitive gaps. In Boston, the alliance claims to empower both carriers with more growth—American expands its global product availability, and JetBlue extends its low-fare/high-quality products to new markets.

So far, the NEA has resulted in approximately 50 new routes out of JFK, LGA, BOS, and EWR; it has increased frequencies on more than 130 existing routes; added 90 nonstop routes with increased capacity; and launched 17 new international routes.

DOJ: “Higher Fares, Fewer Choices”

And the DOJ is seeing red. The department invoked the Sherman Act last year, claiming such an alliance poses harm to consumers by, in fact, decreasing competition and allowing airfares to rise.

The DOJ filed a lawsuit in 2021 to block the partnership, arguing that just four carriers control more than 80 percent of domestic air travel within the U.S. The department adds that the alliance has presented as “an unprecedented maneuver to further consolidate the industry,” quickly resulting “in higher fares, fewer choices, and lower quality service if allowed to continue.” The move also clears the way for other such actions by domestic airline carriers in a continuously shrinking competitive platform.

American is the world’s largest airline by market share and claims its partnership with JetBlue helps them to compete against the dominant carriers in those regions, namely United and Delta.

Photo: Courtesy of Joshua Hanson / Unsplash

The DOJ made its case in U.S. District Court before Judge Leo T. Sorokin last fall, and a ruling is expected early this year.

Projected Cost to Travelers: $700 Million

“This case is straightforward,” the DOJ wrote this month in a legal brief describing its arguments. “The NEA eliminates competition between the largest airlines in the world and a disruptive competitor on flights to and from Boston and New York. It deprives the public of the benefits that the rivalry has brought to passengers for two decades.” The airline industry became heavily concentrated after several mergers in the 2000s and early 2010s.

American and JetBlue account for four-fifths of all revenue earned from flights between Boston and Phoenix, Rochester, Charlotte, Philadelphia, and Washington National Airport, the government said and argued that an alliance could cost travelers as much as $700 million.