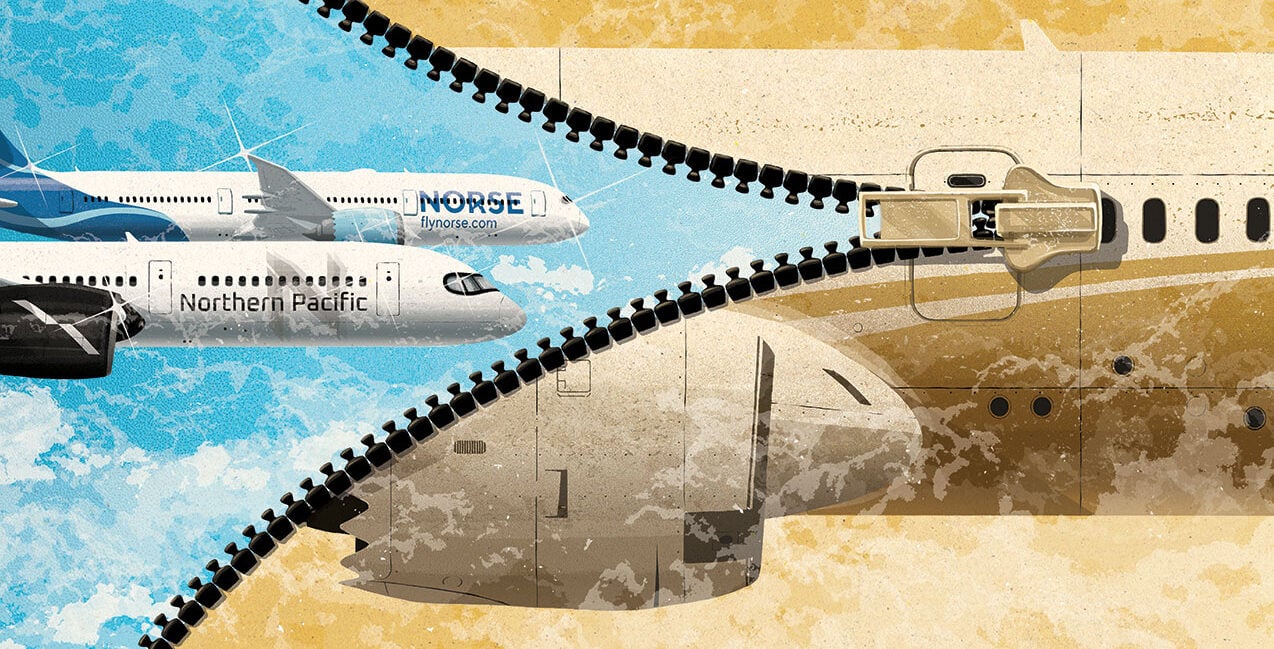

Why Business Travelers Are Flying Northern Pacific Airways and Norse Atlantic

Dive into what Northern Pacific and Norse Atlantic are offering business travelers with new routes between the U.S. and East Asia, and U.S. to Europe

May 2, 2022

Two start-up airlines are offering business travelers new routes between the U.S. and East Asia, and U.S. to Europe

2022 is bringing business travelers new airlines and more choice, with fleets worldwide spending big on new seats to attract returning passengers as a growing number of countries accelerate out of the pandemic and the new world of business travel takes shape. But savvy passengers—especially those who aren’t affiliated to the big alliance frequent flyer programs—may want to look outside the usual suspects for fresh options and great deals up front.

New start-up Northern Pacific Airways is offering connections between the U.S. and East Asia from Anchorage, and fellow newcomer Norse’s model aims at point-to-point nonstops between the U.S. and Europe. If some of that sounds familiar, it should. Northern Pacific basically uses the same model that Icelandair has successfully employed for decades, except flying Boeing 757s via Anchorage over the Pacific rather than via Reykjavík over the Atlantic.

Norse, meanwhile, absolutely doesn’t want you to think of it as the new Norwegian, which shuttered its long-haul operations during the pandemic. But it’s very similar indeed, all the way down to key executives and even the same airplanes.

Norse is using some of the Boeing 787 Dreamliners that Norwegian used to fly, with all its aircraft formerly operated by Norwegian long-haul. But what will these two new carriers offer for the business traveler? Will Northern Pacific stack up against Korean Air or Asiana Airlines to Seoul? What about Norse compared with Air France to Paris or British Airways to London?

Deciding to fly a start-up airline can be something of a risk: The price is likely to be right, but what about the seat, meals, airport operation, digital experience and more? We dive into the two airlines and their models to help you decide if they might be right for your business travel.

Northern Pacific: Icelandair, but Alaska

“As a new long-haul airline, Northern Pacific Airways plans to offer flights between a range of points in the United States and select cities in East Asia through Anchorage, Alaska,” says the airline, noting that it will “serve cities in the states of New York, Florida, California and Nevada, with direct flights to cities in Japan and South Korea through Anchorage over the Northern route.” Anchorage is already a major hub for cargo airlines, whether that’s the big U.S. names such as FedEx and UPS, international cargo operations like Cargolux, or airline-subsidiary cargo fleets like those of Singapore Airlines, Korean Air or EVA Air. Many carriers will do a “gas and go” stop to reduce costs and, in some cases, even allow cargo to change planes to reach its destination.

Northern Pacific hopes to do the same, but with passengers. The Boeing 757 is an interesting choice, though. The aircraft was manufactured between 1981 and 2004, meaning that even the newest airplanes are approaching 20 years of age. When compared with much newer Airbus A321neo or Boeing 737 Max aircraft with bigger bins, advanced interiors and all the bells and whistles, they don’t usually come out ahead without major refits.

That said, depending on what Northern Pacific decides to do inside the airplanes, they may well look the part. Delta Air Lines implemented a full interior refurbishment of its Boeing 757 fleet, with big new bins, in-flight entertainment and everything else to make the cabin look brand-new even on airplanes that would count as “older millennial.”

Onboard, the airline is planning three classes: business, an extra-legroom economy-plus product, and regular economy. Early renderings suggest that the business class will be recliner-style seating akin to that found in a 2-2 layout in U.S. domestic first class on most airlines, while premium economy and economy will use the same seats in a 3-3 configuration.

This is similar to the model that Icelandair has used for the last four years, rather than the previous model Icelandair used for many years until eliminating its popular Economy Comfort offering—essentially the kind of middle-seat-free economy seats that European airlines sell as short-haul business class. But it looks like Northern Pacific’s flights will be quite a bit longer than Icelandair’s. Miami to Anchorage is roughly nine hours. New York is usually scheduled at around eight hours. Anchorage to Tokyo or Seoul will also likely be in that eight- to nine-hour window. Northern Pacific will need to figure out how to design—and price—its product to make 16 hours in the air plus the Anchorage connection palatable.

A key question for Northern Pacific will be whether it can undercut its competitors’ more fuel-efficient aircraft at a time of peak fuel prices, to the extent that passengers will be willing to take the trip via Anchorage rather than flying nonstop on the multiple U.S. and Asian carriers that serve the transpacific routes. Of Northern Pacific’s currently released routes, this may be an easier sell for passengers originating in, say, Florida or Nevada rather than California or New York, which have substantial nonstop service.

All in all, if you might consider Icelandair over the Atlantic, you might well find some value in the Northern Pacific offering. Most business travelers, though, are likely to be more easily persuaded to connect on a long-haul wide-body instead.

Norse: Norwegian, but the Planes Are Blue

Changing oceans from the Pacific to the Atlantic, and models from hub-and-spoke to point-to-point, we come to Norse, which plans to operate Boeing 787-9 Dreamliners connecting cities nonstop with a long-haul, low-cost model. “We are a point-to-point carrier that will connect exciting destinations in Europe and the U.S., including New York, Los Angeles, Fort Lauderdale, Oslo, Paris and London,” says chief communications officer Lasse Sandaker-Nielsen. “Direct flights with modern and more environmentally friendly Dreamliners will be the fastest, most affordable and carbon-friendly transatlantic option.”

While those claims may be debatable, this kind of long-haul, low-cost model has worked in some markets. Qantas’ Jetstar subsidiary and Singapore Airlines’ low-cost outfit, Scoot, are successful, although other attempts have been less so.

“We have a premium cabin and an economy cabin,” says Sandaker-Nielsen, noting that “our offering is based on freedom of choice, which means that you may pay for the frills you would like in addition. The premium cabin will include more items, but we have not yet announced those details. What we can say is that it will be the smart option for cost-conscious business travelers.”

It’s not clear yet whether the cabin layout will be the same as the old Norwegian, which offered 56 premium recliners in the first cabin of the 787-9 with a 2-3-2 layout at a very generous 43-inch seat pitch, around five to seven inches more than many other premium economy seats. The airline announced its Dreamliners in 2010 and put them into service in 2013. Norse, doing so a decade later, has the option of a new generation of business-class seats, particularly those that can be pitched in the region of 40 to 42 inches while still offering a flatbed and direct aisle access for every passenger.

These include the Optima from Safran (seen on United Airlines and Air France, among others), the Opal from Stelia (on Garuda and Air Senegal), and the CL6710 from Recaro (used by El Al and TAP Air Portugal). Other options may be available, as well. Given that its aircraft are not coming fresh off the Boeing factory line, Norse has a wider choice of seats than it would if the jets were newly built, since Boeing (and indeed Airbus) limits the seats that can be installed to a subset of previously approved manufacturers. For many business travelers, if priced keenly, a flatbed on Norse would trump a premium economy seat on the competition, and in some cases even an older business class seat that didn’t offer direct aisle access.

Norse will, however, need to ensure that it doesn’t suffer Norwegian’s infamous operational disruptions, aircraft substitutions and general unreliability. The causes for this were multiple, including problems with the 787 aircraft and their Rolls-Royce engines, but these were amplified by Norwegian’s too tight scheduling of its aircraft, which couldn’t recover from delays.

Since then, the technical hang-ups that befell Norwegian with these aircraft have largely been resolved, and if Norse implements a more sensible schedule it may be able to find a niche. Another key question will be the response from airlines already operating those routes, particularly to London, where British Airways and Virgin Atlantic already compete from the New York tristate, Southern California and South Florida metropolitan areas. When Norwegian last tried long-haul out of London Gatwick, British Airways responded with a major initiative to expand its lower-cost holiday market fleet at London’s second airport.

Since then, British Airways has revealed plans to build up its short-range holiday-focused services at Gatwick. It would be logical if this then made it easier for BA to respond with a “Norse killer” to once again defend its market. At the end of the day, if Norse can establish itself as a kind of “Norwegian without the problems,” it’s likely to be an attractive option for some business class travelers, especially if it offers a keenly priced premium cabin with recliners or even flatbeds.

Play That Song Again?

Another familiar model—and yet another different one—is new Icelandic airline Play. If Norse is the new Norwegian, then Play is the new Wow Air, offering low-cost connections from North America to Europe over Reykjavík airport in Iceland.

Officially, this carrier is not for business travelers, spokesperson Laura Shubel tells us. “The airline’s low costs and business model appeal to a wide market, from families to young travelers and students.

“Play has an all-economy cabin, with no business or premium classes,” she continues. “A personal item is included for the flight, and passengers can choose from upgrades such as a carry-on, checked bag, seats with extra legroom, cancellation protection, and more.”

Round-trip summer flights are remarkably inexpensive: around $500 for an August week in Paris leaving from Stewart Airport about 60 miles north of New York City. Seating fees range from $5 to $50, meaning that a relatively comfortable overnight hop is well within reach. There’s little luxury there, although a mini bottle of Moët & Chandon is available for about $25.

But nonetheless, Wow, and indeed Icelandair before it, attracted several kinds of business travelers. People flying between secondary cities that would already require at least one and sometimes two connections look at a single, hour-and-a-bit connection in Reykjavík (rather than, say, London Heathrow or New York JFK) as an upgrade. Freelance or gig-economy travelers looking for the lowest possible fare also find value in the ultra-low-cost carrier model.