Photo: Boeing's Renton Factory, First 737 MAX. Courtesy of Boeing Commercial Airplanes

Boeing has revealed plans to add a fourth production line for its best-selling 737 MAX in the second half of 2024. The North American planemaker has chosen its increasingly underutilized Everett, WA, factory to boost the output of the famous single-aisle aircraft.

The manufacturer has a backlog of 3,600 orders for the four 737 MAX variants (MAX 7, 8, 9, and 10) but is currently limited to producing about 31 airplanes a month. However, the company plans to ramp up production to a rate of approximately 50 per month in the 2025 to 2026 timeframe.

According to reports in Reuters, Stan Deal, CEO of Boeing Commercial Airplanes, told staffers in a note that the company will continue production on the three 737 MAX lines at its Renton, WA, facility. Two of those lines are currently operating, and the third, which had been dormant since production was halted in 2019, is set to be reactivated.

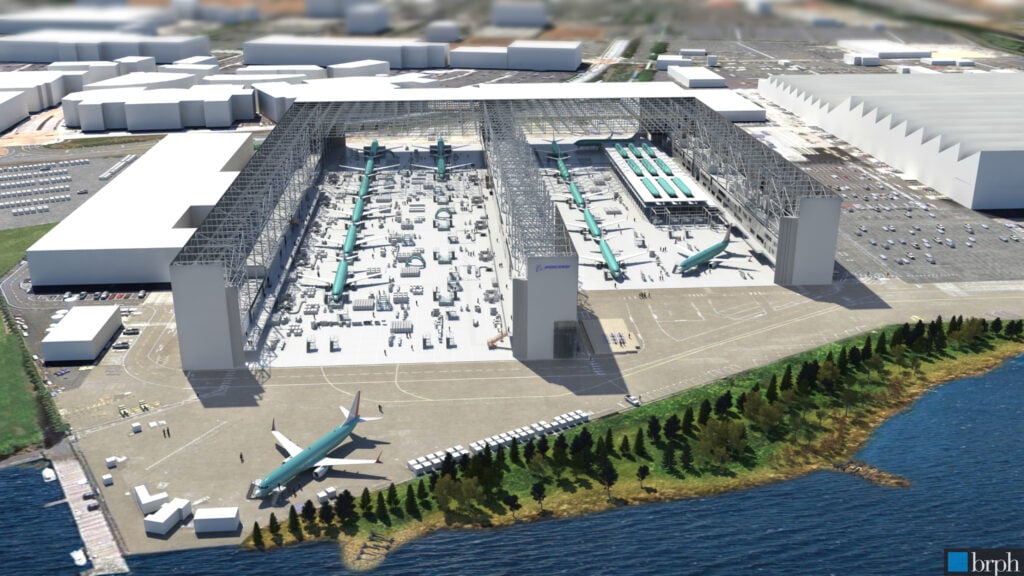

Photo: Renton 737-MAX Factory Renderings. Courtesy of Boeing Commercial Airplanes

The new Everett line will occupy space dedicated to the assembly of the 787 Dreamliner before that operation was moved to North Charleston, SC, in 2021. For over 50 years, the massive facility—said to be the largest building in the world by volume—was also home to the 747 jumbo jet, which delivered its last-ever airframe yesterday in a historical event.

The last “Queen of the Skies” rolled off the line as a freighter, later delivered to cargo carrier Atlas Air. As a result, the Everett plant was left with production lines for 777s and 767s, with some of the space given over to reworking 787 Dreamliners.

Opening the third and fourth lines for the 737 MAX should give Boeing the capacity to boost production to levels last seen in 2019—before the aircraft was grounded following two fatal accidents.

While the 737 MAX family was recertified and returned to service at the end of 2020, supply chain issues and labor constraints have made the manufacturer reluctant to increase output too quickly, according to the Boeing Company’s CEO Dave Calhoun, keeping production stabilized at about 30 aircraft per month.

Competitor Airbus is also facing supply chain issues but is still averaging more than 40 deliveries per month of the single-aisle A320 family, its rival to the MAX. Next year, the European manufacturer targets the production of 65 aircraft per month, ramping up to 75 per month in 2025.

Photo: First Boeing 737 MAX 7. Courtesy of Boeing Commercial Airplanes

In addition to competitive pressures, Boeing is anticipating regulatory approval of two new MAX variants, the MAX 7 and MAX 10. The future of those models was in question until Congress intervened in the closing days of its last session to grant an extension for the two types to be certified under pre-2020 regulations.

In his message to Boeing employees, Deal said increased capacity will be necessary to meet growing demand, particularly for higher-density models like the MAX 8-200 (already in production) and MAX 10, which the company expects to be certified and ready to deliver next year.

Meanwhile, airlines continue to place new orders for the aircraft. Last year, Boeing added nearly 700 new orders for the MAX with major carriers, including Delta Air Lines, United, and Southwest.

Despite Boeing’s eagerness to ramp up production, getting a fourth line operational at the Everett facility is projected to take more than a year. According to an announcement last week, along with changes to the physical plant and some daunting logistical challenges, the manufacturer plans to hire around 10,000 workers this year.

“This undertaking is significant,” Deal told employees. “In addition to preparing the facility, we have begun the process of notifying and preparing our suppliers, customers, unions and employees as we take the necessary steps to create a new line.”