Photo: Courtesy of Lisboa Airport

Airports may be basking in record-high traveler satisfaction, but the applause comes with an asterisk. While 79 percent of global travelers say they’re pleased with the airport experience—up nine points from last year—many are also sounding a warning: today’s airports are not keeping up with the expectations of their most valuable customers.

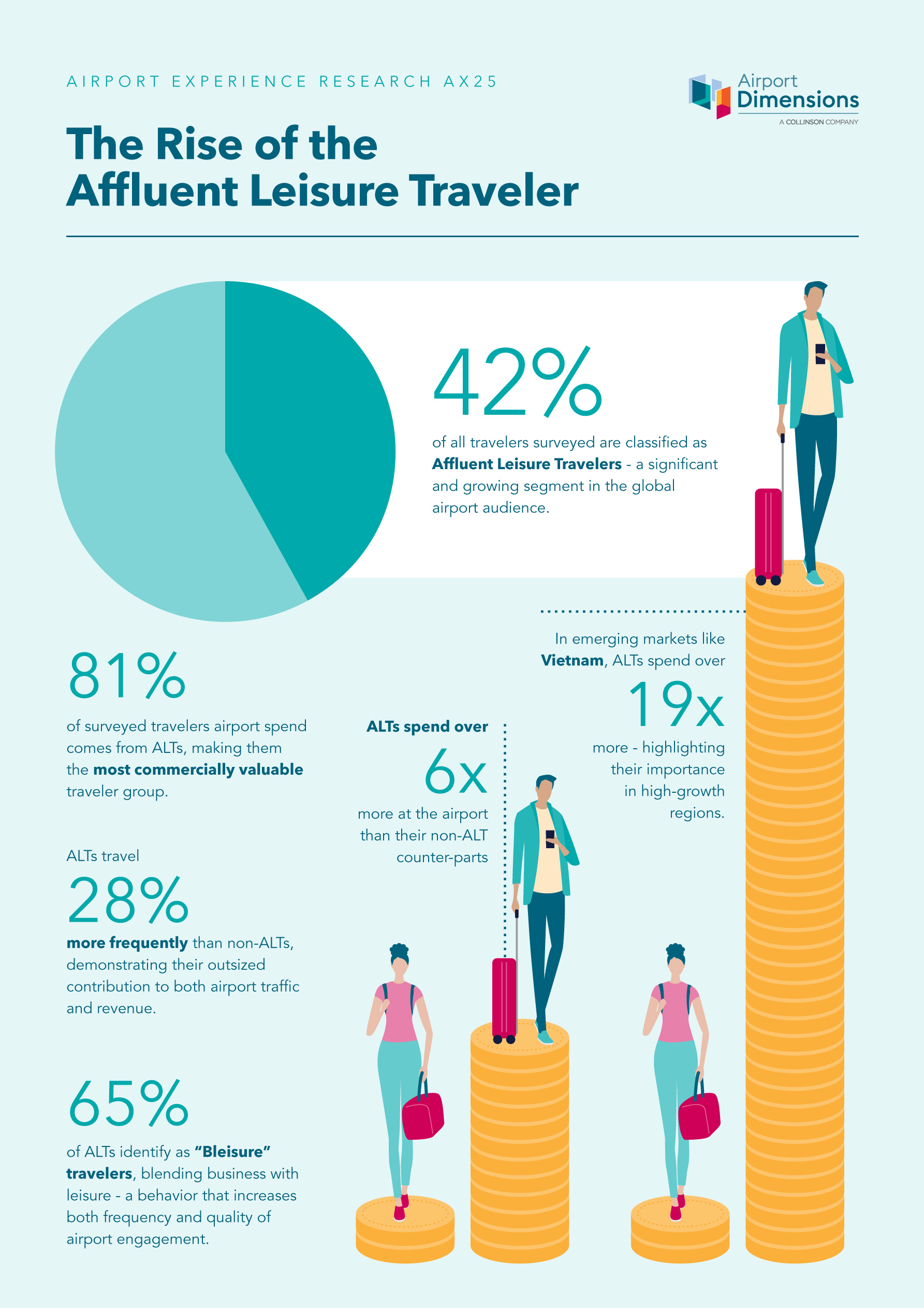

According to the newly released AX25 Airport Experience research by Airport Dimensions, a seismic shift is underway. A new breed of passenger—the Affluent Leisure Traveler, or ALT—is rapidly becoming the linchpin of airport revenue. And they’re not easily impressed.

Graphic: Courtesy of Airport Dimensions

“The Affluent Leisure Traveler represents a growing and influential segment of today’s airport audience,” said Mignon Buckingham, CEO of Airport Dimensions. “This group is showing a clear willingness to spend when the offer aligns with their values and lifestyle.”

ALTs now represent 42 percent of frequent fliers surveyed but account for a striking 81 percent of all reported airport spend. They’re not just more present in airports—they’re redefining what a quality airport experience means.

Crowding and Congestion: The Weakest Link

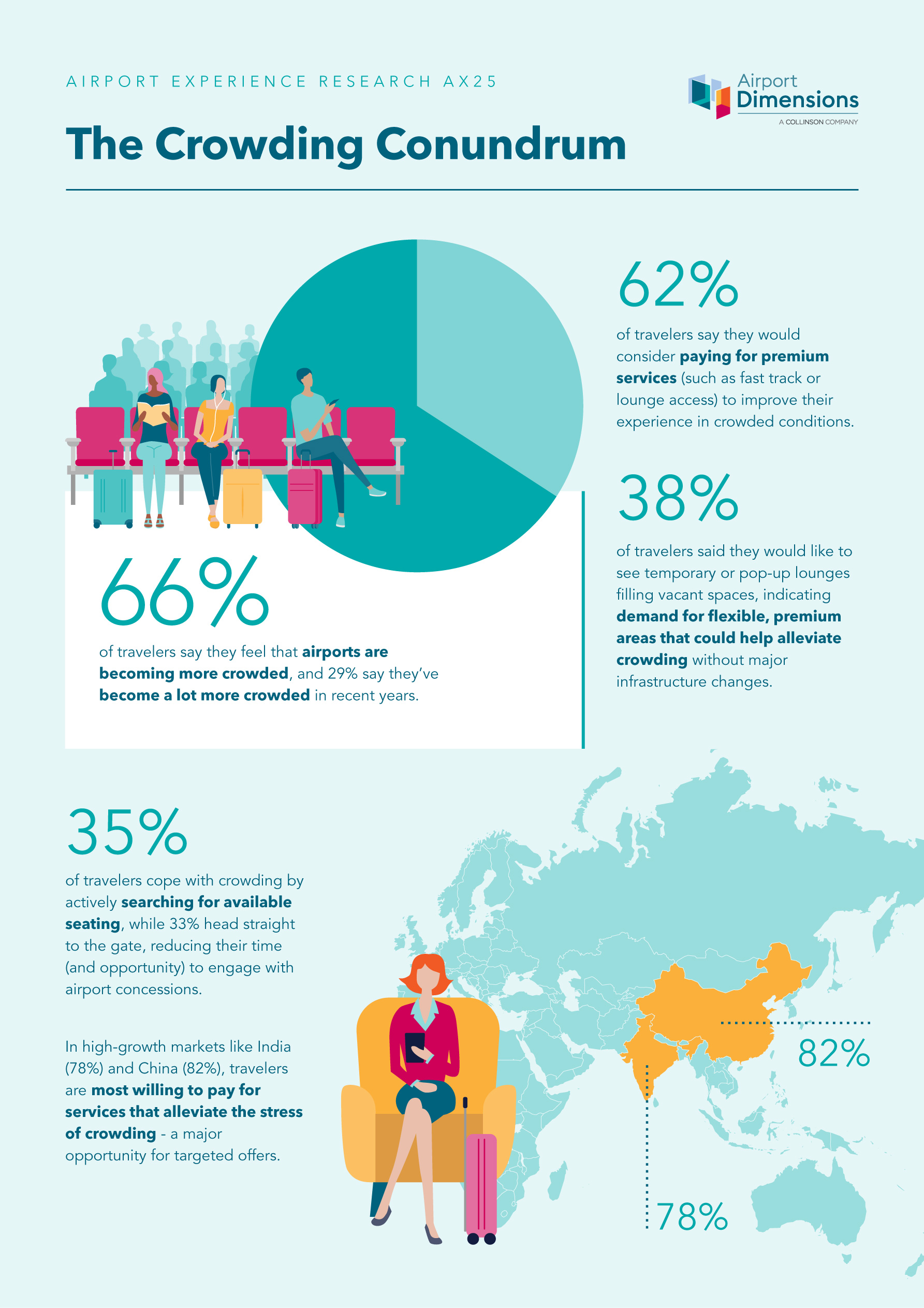

Despite the positive headline figures, airports are facing growing discontent around physical capacity and comfort. Two-thirds of travelers (66 percent) say airports feel more crowded than before, with nearly 30 percent saying crowding has become “much worse.” Only 10 percent believe crowding is improving.

This isn’t just a minor nuisance—it’s a structural problem for airports, especially as global air traffic is expected to more than double by 2053. And infrastructure, particularly in mature or space-constrained markets, isn’t growing fast enough to meet demand.

Graphic: Courtesy of Airport Dimensions

This imbalance is driving traveler stress and reshaping behavior: 35 percent now search for any available seat upon arrival, and 33 percent head directly to the gate to avoid the chaos. For business and premium travelers accustomed to comfort and control, this isn’t sustainable.

Yet there’s a silver lining: opportunity. The study found that 62 percent of travelers are willing to pay to escape the crowd, whether through fast-track security, lounge access, or other premium services. That number soars to 82 percent in China, 78 percent in India, and remains high in the UAE and Saudi Arabia—regions where affluence, digital adoption, and a culture of convenience drive higher expectations.

Lounges Go Mainstream—And Loyalty Follows

The days when airport lounges were reserved for business class elites are over. Today, 42 percent of all travelers say they’ve accessed a lounge in the past year, with Millennials now leading usage. What was once a luxury is now seen as essential.

Programs like Priority Pass and credit card-linked lounge memberships are surging. And travelers are prepared to walk if their access is revoked.

Photo: Vienna Lounge. Courtesy of Priority Pass

A staggering 97 percent of lounge program members said they would not give up access. In fact, 45 percent would switch banks, and 33 percent would pay per visit if lounge benefits disappeared.

For airports and financial institutions alike, this signals just how deeply lounges have become entwined with brand loyalty—and how critical it is to maintain access, comfort, and service quality.

Retail Is Under Pressure

Even as overall satisfaction rises, there’s a noticeable dip when it comes to perceived value. Only 59 percent of travelers say airports offer good value for money, and 21 percent cite pricing as a top pain point—making it the leading source of dissatisfaction in the study.

Photo: Courtesy of Denver International Airport

This dissatisfaction grows as travelers gain more tools to compare prices. With e-commerce and mobile apps offering real-time benchmarks, passengers are less likely to tolerate inflated prices on bottled water, snacks, or basic souvenirs.

What’s more, 38 percent of travelers said they’d spend more if airport prices matched those outside the terminal. The implication is clear: airports must rethink outdated retail models that rely on high-margin, captive audience pricing. Value-driven spending—especially among digitally-savvy ALTs—is the future.

Pop-Ups and Flexible Concepts

Given that physical expansion isn’t always possible, many airports are now looking inward—literally. Underused spaces are being reimagined for new retail and service concepts.

Photo: Terminal TBIT. Courtesy of Los Angeles International Airport / Joshua Sudock

The AX25 report found that travelers are increasingly receptive to innovations such as pop-up lounges (38 percent) and local retail kiosks (36 percent) in less-trafficked corners of the terminal. These flexible models not only help mitigate crowding but also create opportunities for high-margin, low-footprint revenue.

Importantly, these services appeal directly to the ALT mindset: experience-led, personalized, and differentiated from the generic mall-like feel many terminals still project.

Digital Tools and Loyalty: A Missed Opportunity

Despite travelers’ increasing fluency with digital platforms, airport-provided tools remain significantly underused. Yet the appetite is there: 73 percent say loyalty programs encourage more spending, and 83 percent say better pricing would incentivize digital purchases.

What travelers want is not more apps, but smarter ones. 56 percent said they’d prefer a single, unified app that handles everything from wayfinding to shopping to service upgrades—especially in markets like China, India, and the UAE, where digital-first experiences are already the norm.

Graphic: Courtesy of Airport Dimensions

In China, for example, 91 percent of loyalty program members say participation influences their airport spending—the highest rate among all countries surveyed.

With airline loyalty programs losing their edge, airports have a unique window to step in and own the customer relationship. But doing so requires personalization, transparency, and better use of data—not just another app icon on the traveler’s phone.

High Satisfaction, Higher Stakes

The AX25 study paints an encouraging picture of rising satisfaction and engagement. But it also warns of a new standard being set—one defined by the high-spending, comfort-seeking ALT segment.

Meeting this moment doesn’t require tearing down terminals or launching flashy new attractions. Instead, it calls for smart, data-informed evolution: offering more premium services to alleviate crowding, repricing retail to reflect real-world value, digitizing the experience for seamless engagement, maximizing underused space with meaningful services, and reinventing loyalty to build direct traveler relationships.

As Buckingham says: “It’s a timely opportunity to reimagine the journey with these travelers in mind—not at the expense of others, but as a way to raise the bar for everyone.”

For airports, the message is simple: evolve or risk irrelevance. In a world where physical space is finite and expectations are growing, the winners will be those that can innovate within their walls—and build stronger connections beyond them.