Mastercard and TransferWise Partner to Serve More Working Expats

As business travelers look to work from foreign locales for extended periods of time, borderless banking expands

August 20, 2020

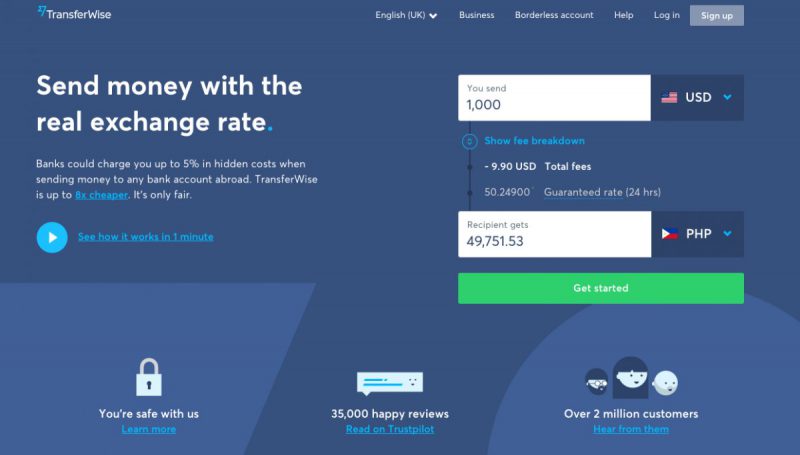

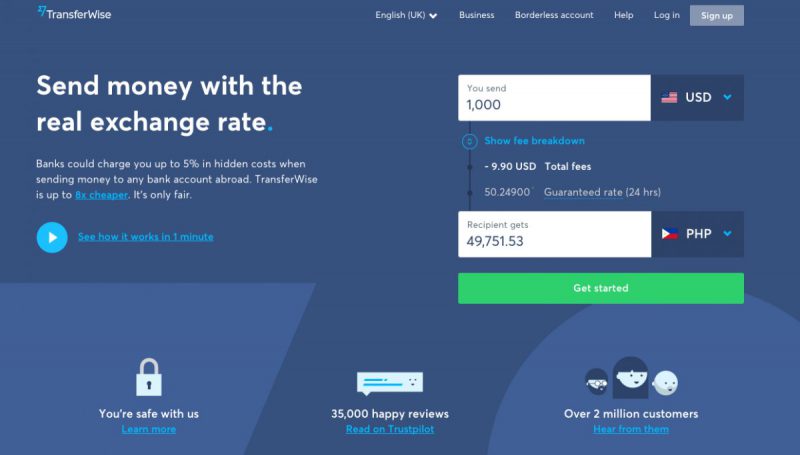

In today’s pandemic economy where countries like Bermuda are offering extended stays to expats who want to work remotely away from their home countries, it is not surprising that TransferWise, a global technology company that helps people manage their money across borders, is expanding.

The company has announced that it was strengthening its partnership with Mastercard to enable the issuance of cards in any market around the world where Mastercard is accepted and TransferWise is licensed.

TransferWise partners with Mastercard in the European Union, the US, Singapore, Australia and New Zealand. Japan will launch later this year. The company’s borderless account lets customers hold over 40 different currencies and send and spend money overseas using a contactless TransferWise debit Mastercard.

TransferWise’s customers are expats, freelancers, businesses and travelers who use the borderless account as an international banking alternative. Customers can use the service to make international payments, access funds or transfer money to friends or relatives.

Money transfers to Mastercard holders can be done now in some cases in real time in countries like Spain, Romania, Bulgaria, Czech Republic, Hungary, Poland, Ukraine, Georgia, Croatia and Russia.

“We’re making it faster, cheaper and easier to move money around the world,” said Kristo Käärmann, CEO and co-founder of TransferWise in a statement. “To date over one million debit cards have been issued to people wanting to make the most of everything our borderless account has to offer. As we think about the next phase in our international expansion, we want to ensure this process stays just as convenient whether you need a debit card in the UK or Japan.”

TransferWise is a London-based online money transfer service that was started in 2011 by a former Skype executive Kristo Käärmann and Taavet Hinrikus, both from Estonia.

The company has recently reported a net profit of $8 million with a customer base of about 4 million, worldwide.