Airline Baggage Fee Revenues Sky High

A CarTrawler global estimate of baggage fee revenue reveals 110% increase from 2014 estimates of $13.4 billion

May 5, 2019

IdeaWorks and CarTrawler combined efforts in a new global study and found airline ancillary revenue is now at $92.9 billion worldwide. It turns out that baggage fees account for $28.1 billion of that number as a component of revenues for 20 top airlines.

Each year the survey analyzes the ancillary revenue disclosures for airlines all over the world. These results are applied to a larger list of carriers (which numbered 175 for 2018) to estimate ancillary revenue activity for the world’s airlines. Baggage activity for each category of airline is added to this analysis to calculate a global estimate. It’s a significant component of ancillary revenue and consists of three primary sources: checked baggage in the aircraft belly, added fees for heavy and extra-large bags, and for some airlines, the price charged for larger carry-on bags.

Stringent baggage fee policies are hallmarks of top revenue-performing low-cost carriers. The surprising development within the last two years is the implementation of bag fees by some of the world’s leading global network airlines.

The CEO of Hungarian low-cost carrier Wizz said earlier this year that its stricter hand luggage policy had increased unit revenue per passenger 7 per cent.

“The value of airlines’ a la carte revenue, or optional extras that customers can add to their basic airline fares, has risen dramatically in recent years, growing by 128% between 2014 and 2018. So, it is no surprise that baggage fee revenue has grown by a similarly huge margin, in terms of both monetary value and as a percentage of overall global airline revenue. This overall trend reflects traditional airlines’ strategy of embracing a la carte revenue alongside low-cost providers, offering customers the best-value solutions in a transformed marketplace,” said Aileen McCormack, CarTrawler’s chief commercial officer.

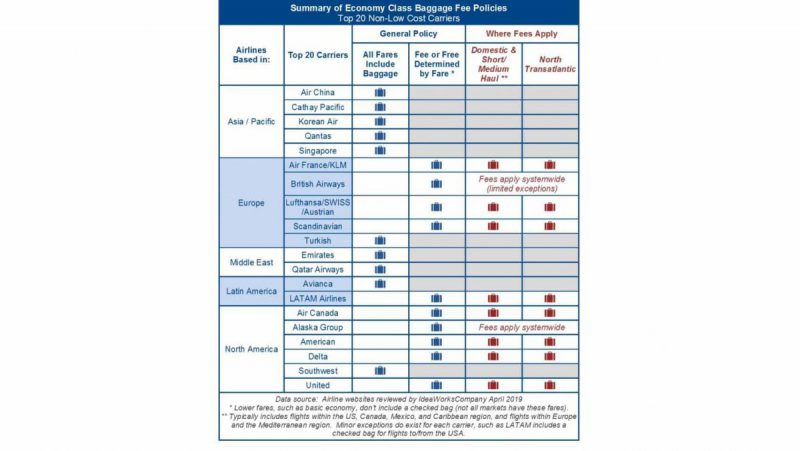

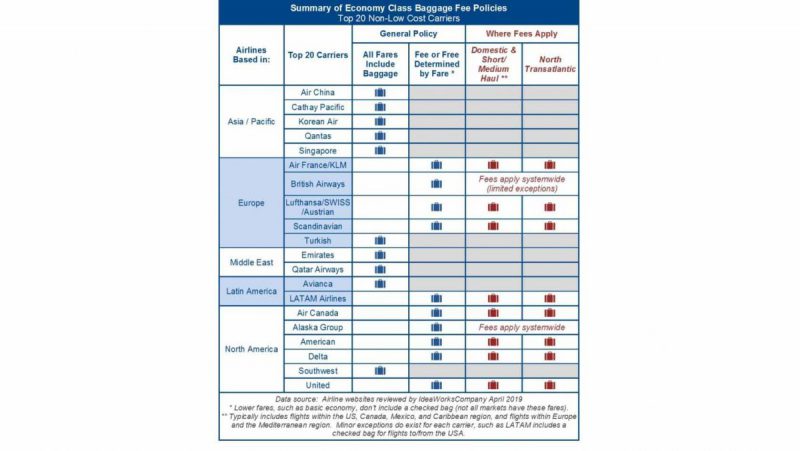

The table above lists the baggage fee policies for 20 top non-low cost carriers, which just a few years ago would have displayed far less baggage fee activity. Today, only half the airlines listed rely upon the traditional method of including checked baggage as a feature for all fares.

The other half have implemented bag fees on a portion or the entirety of their route network. When these airlines are organized by global region, it’s easier to see the policy groupings that currently exist. The abundant reliance upon bag fees in Europe and North America occurs largely due to the presence of a very significant low-cost carrier industry. Elsewhere in the world, traditional airlines include baggage benefits for all fares and have not yet adopted basic economy fare strategies.

The airlines that did not add checked bag fees were primarily in Asia-Pacific and the Middle East; namely Air China, Cathay Pacific, Korean Air, Qantas, Singapore Airlines, Emirates and Qatar, as well as Turkish and Southwest.

The airlines found to add bag charges based on fare were Air France, KLM, British Airways, Lufthansa, Swiss, Austrian, Scandinavian, LATAM, Air Canada, Alaska, American, Delta and United, according to earlier reports in Business Traveller.